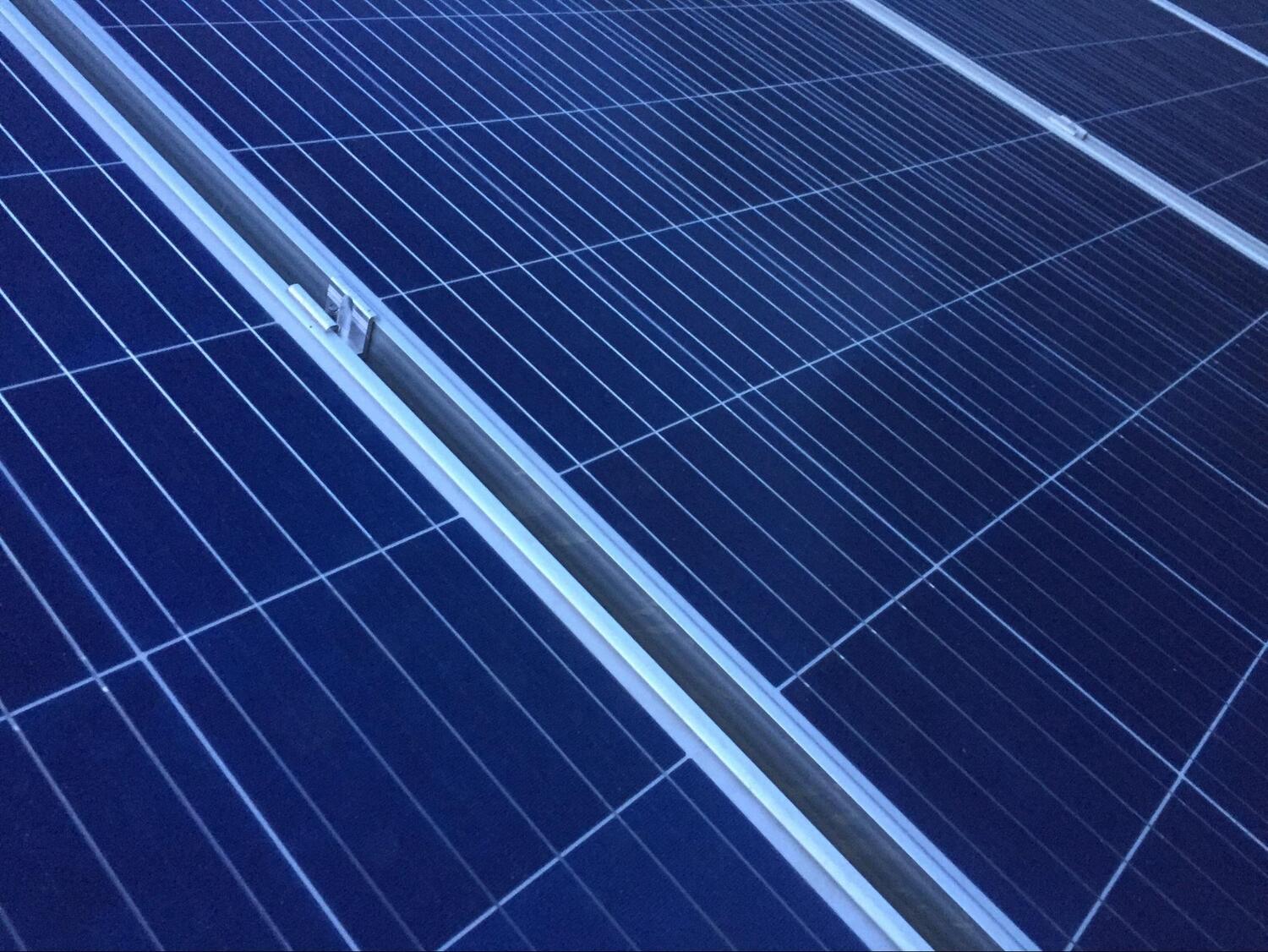

One of the most common things we hear out on the streets when talking to California residents is they’ve been meaning to invest in a solar panel system, “but can’t right now.”

Life comes at you fast and it’s hard to do everything, but waiting to invest in a solar panel could cost you BIG BUCKS. Particularly when the future of California solar rebates is so unclear.

Read on to learn why you should not wait to take advantage of solar power in your home or commercial property.

You should take advantage literally right now

Why wait to start the rest of your life? There are a lot of reasons to take advantage of solar panels as soon as possible.

- You’ll save more money: As you’ll read below, federal tax credits are quickly expiring. By waiting, you’ll be losing out on thousands of dollars you could get in the form of a solar tax rebate.

- Your home will be left in the dust: Starting in 2020, all new homes built will be required to include solar panels. This will make your home seem outdated when it comes time to sell you home. Installing new panels will show buyers that you’ve kept up with maintenance and have invested in your home.

- You’re losing money every day you don’t have solar power: Why not take the power back now? You can reduce your electricity costs by 66% overnight and stop letting your hard earned cash circle the drain.

Federal solar tax credit

While solar panel incentives will continue to be robust for the foreseeable future, the federally funded Investment Tax Credit will be dwindling down to nothing after 2019. While in 2019 residential and commercial properties receive a 30% solar rebate, in the coming years the ramp-down will be as follows:

- 2020: 26% rebate for commercial and residential properties

- 2021: 22% rebate for commercial and residential properties

- 2022: 10% rebate for commercial properties and ZERO rebate for residential properties

This change will be a missed opportunity if not taken advantage of ASAP. This applies to the tax year the system is functional, so don’t wait a second to get started!

How is the tax credit issued?

The tax credit is issued as a federal rebate against your tax bill the year your solar panel system starts operating. If your credit is higher than your tax bill, the remaining balance will go towards following years’ balances.

$10,000

Solar panel system

$3,000

Tax rebate

$2,000 2019 Tax Bill

Tax owed=$0

$2,000 2020 Tax Bill

Tax owed=$1,000

Who is eligible for the federal tax rebate?

For both commercial and residential solar panel systems, the first and most important requirement for receiving the solar tax rebate is to OWN and not LEASE the solar panel system.

- Residential California solar rebate: Must be a homeowner that’s providing energy for their home, which must be meeting all electrical and fire codes. Basically, ALL HOMEOWNERS ARE ELIGIBLE.

- Commercial California solar rebate: Must be a business or commercial building that’s purchased a new (not used) system to power their building. The building must be in the United States and not be powering a swimming pool. Lastly, you must be paying US taxes, which excludes charities, schools, and churches.

Are there still California solar rebates?

California is truly a revolutionary state when it comes to solar panel investment. When Governor Arnold Schwarzenegger’s Million Solar Roofs program was launched in 2005, it was the first of its kind. It was intended to get California to decrease its reliance on fossil fuels and develop a solar panel industry creating jobs and facilitating innovation. Guess what?! It worked!

But with the popularity of solar panels increasing (the secrets out!), California solar rebates have all but been eliminated besides having the ability to exempt the cost from your property taxes. While some cities (such as Los Angeles to Glendale) have local California tax credits, no California solar rebates remain.

People are wising up to the reality. Solar panels are an excellent value for your home. This has made the demand increase, and the amount the state is willing to incentivize you to make the investment go down.

Why do rebates and incentives exist??

Incentives for investing in solar panels are intended to increase their use! By installing solar panels, you are:

- Helping the environment. Every kilowatt you use through solar panels over coal makes the world just a little bit happier.

- Encouraging investment in not only solar panels, but green energy. Investors gauge success through revenue. If people buy solar panels, it encourages more investment. As investment comes in, jobs are created to make use of the investment.

California’s solar rebate plan has been a success on all three of these levels, creating a robust solar industry in the state of California.

Why not take the power back now? Contact Inter Faith Electric & Solar today!

Why wait when you can start saving money today? Every hour of every day that you don’t have solar power you’re losing money you can spend on other things in your life. There’s no reason to not invest today.

And make sure you always buy and don’t lease your solar panels. Leasing panels may seem like the cheaper and more cost-effective option, but nothing is further from the truth. Take a look for yourself:

When you lease

- The panel owners get all the tax credits

- A lien is put on your house

- Your monthly payments may increase

- Your total electric costs can be as high as $.18/kwh

When you buy

- You get state AND federal tax credits

- Your home value increases

- You get flat monthly payments

- Your total electric costs will be as low as $.06/kwh

Take back the power with Inter Faith Solar and Electric! Contact us online to learn how to make your power source work for you!

Leave A Comment